(For the most recent data, go here )

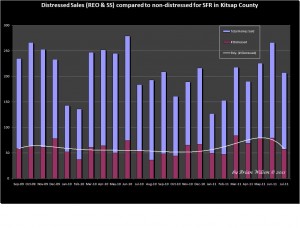

In the 4 months since I last reviewed this data (March 2011), it appears that Distressed properties are continuing to comprise about 30% of the total property Sales in Kitsap County. There appears to be a slight declining trend developing. In each of the last 4 months, distressed properties as a percentage of total property sales have been declining from 36% in April to 28% in July. This is still a high percentage and is still having a negative impact on resale home prices, but it is good to see a declining trend and I hope it continues.

In analyzing the data, there is a very interesting trend developing. The percentage of distressed property sales that are comprised of Short Sales compared to REO (Bank Owned) sales has been dramatically increasing! In the previous 19 months, Short Sales had consistently comprised about 25% of the total distressed property sales. In two of the last four months Short Sales comprised 50%! Of the total distressed property sales and in the other two months, Short Sales were 30% of those respective monthly distressed property sales.

It may be a bit early to draw a conclusion from this, but I think it is indicating that Banks are beginning to work harder to accommodate Short Sales rather than foreclose on distressed mortgagors (borrowers)! I have commented and it has been in many publications, that Bank Owned Real Estate (REO’s) have been underselling the current market prices for homes by a national average of 30-35%. This number varies quite a bit from area to area, but the data is clear: REO properties are being sold at below current market values and have continued to put significant downward pressure on all resale home prices.

I’m thrilled if this trend continues, because while Short Sales are often sold at a discount, they are discounted much less than if the home were an REO property and this will contribute to stabilizing home prices!

There are other potential negative issues for the mortgagor with Short Sales, but overall, I think it is a positive development for the Real Estate Market.

-Brian Wilson, Broker

John L. Scott Real Estate – Poulsbo

Speak Your Mind